Senate Bill 711

Status: Signed into Law (October 1, 2025)

Effective Date: Immediate (Urgency Statute); Operative for tax years beginning January 1, 2025

Primary Focus: Federal Tax Conformity and Spousal Support Taxation Reform

Senate Bill 711 (McNerney), also known as the Conformity Act of 2025, represents the most significant update to California’s tax code in a decade. The bill advances California’s “conformity date” with the federal Internal Revenue Code (IRC) from January 1, 2015, to January 1, 2025. By aligning state law with federal standards, SB 711 simplifies tax preparation for millions of Californians, particularly regarding the treatment of spousal support, research credits, and business expenses.

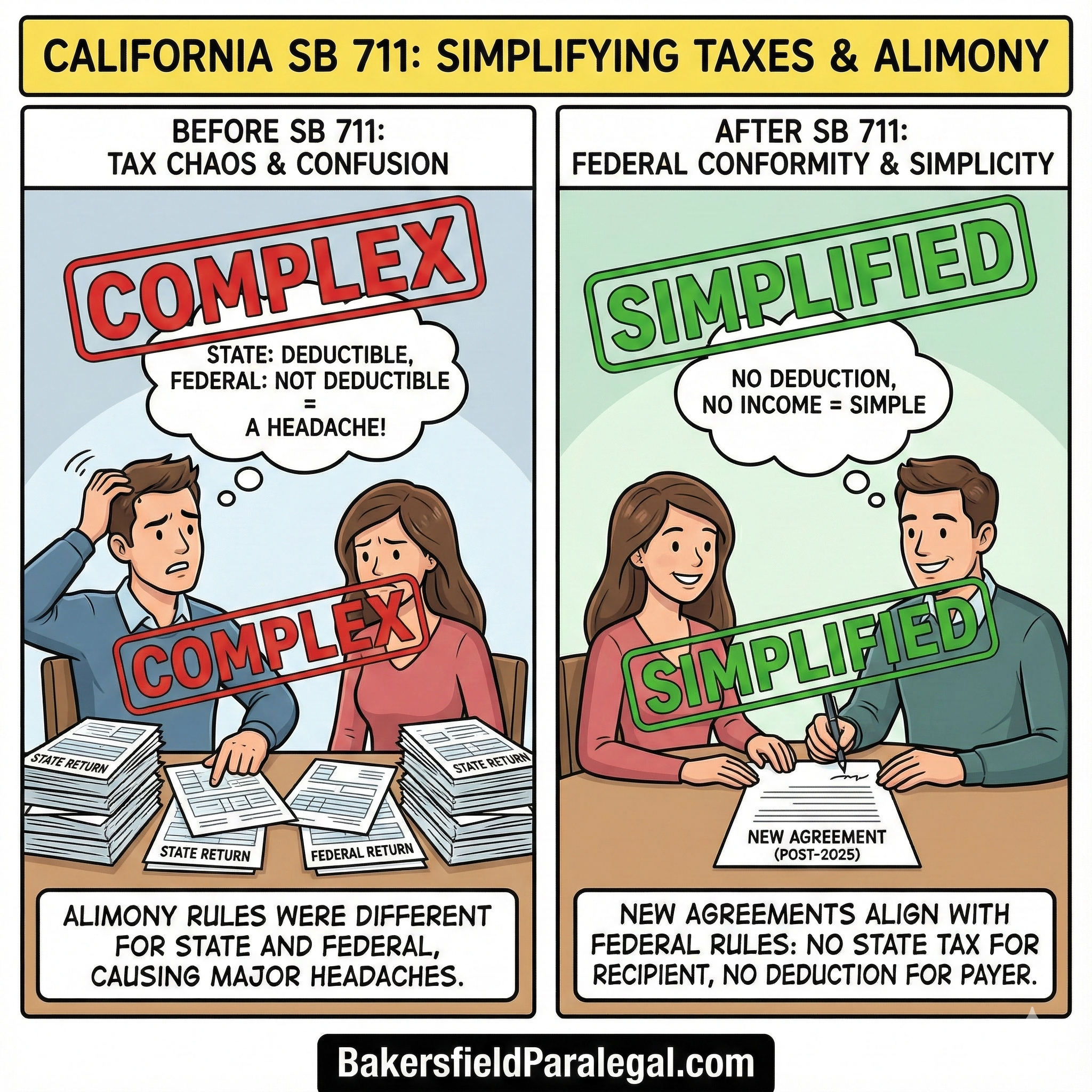

1. Major Change: Spousal Support (Alimony)

- Tax-Neutral Treatment: SB 711 finally aligns California law with the federal Tax Cuts and Jobs Act of 2017 regarding alimony.

- New Agreements: For divorce or separation agreements executed after December 31, 2025, spousal support is no longer deductible by the payor and is no longer taxable income to the recipient.

- Existing Agreements: Agreements finalized on or before December 31, 2025, generally retain the prior “split” treatment (deductible on state returns, not on federal returns) unless specifically modified to apply the new law.

2. IRC Conformity Date Update

- A Decade of Updates: By moving the conformity date to January 1, 2025, California automatically adopts hundreds of federal tax changes made over the last 10 years that the state had previously ignored.

- Reduced Discrepancies: This reduces the “book-to-tax” adjustments and complex schedule reconciliations previously required for taxpayers to report different values to the IRS and the Franchise Tax Board (FTB).

3. 1031 Like-Kind Exchanges

- Real Property Limitation: SB 711 conforms to federal restrictions that limit the deferral of capital gains in Section 1031 exchanges strictly to real property.

- Tangible Property: Deferrals are no longer permitted for the exchange of personal or tangible property (such as equipment or vehicles), ending a long-standing point of confusion between state and federal filings.

4. Research & Development (R&D) Credits

- Simplified Methodology: The bill adopts the federal “Alternative Simplified Credit” (ASC) method for calculating R&D credits.

- State Percentages: While adhering to the method, California sets its own credit rates (3% and 1.3%) to maintain fiscal balance and encourage continued innovation in the state.

5. Areas of Non-Conformity (Decoupling)

Despite the broad alignment, SB 711 explicitly chooses not to conform to certain federal provisions, including:

- Corporate AMT: California declines to adopt the new federal 15% Corporate Alternative Minimum Tax.

- Net Operating Losses (NOLs): The state continues to maintain its own unique rules for how businesses carry forward or carry back financial losses.

- Bonus Depreciation: California still does not allow the immediate “expensing” of certain business assets permitted under federal law.